Act Now to Stop Maryland Vape Tax Hike

Maryland HB 1414 would jack up the tax on vapor products from 12% to 30% retail. This bill is scheduled for a hearing in the House Economic Matters Committee on

- Tuesday, March 5, 2024

- 1:00 PM

- House Office Building, Room 230, Annapolis, MD

Please take a minute to send an email to your lawmakers urging them to oppose HB 1414! Click here or on the banner below to access the CASAA Call to Action.

VAPERS PAYING MORE HELPS BIG TOBACCO

There are two reasons why prefilled pods and combustible cigarettes manufactured by Big Tobacco are hemorrhaging sales to disposable vapes. The first is that prefilled pods are only available in artificial tobacco flavors, not the popular fruit and beverage inspired flavors that can be found in every single consumable product on the market.

Products ranging from kombucha to hard seltzer feature artificial flavor profiles that are very similar to those which are vilified when used in popular vape juices. It is almost impossible to imagine an adult appealing consumable product anchored on the cloying notes of fauxbacco. Possibly a coffee blend? It is a very short list.

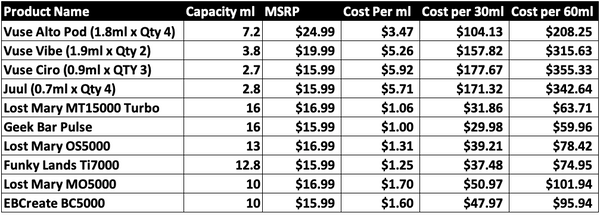

Then there is the price issue. The difference in cost per 30ml of e-liquid vaped is massive. The consumer is not the only beneficiary of fair competition. Products from the independent vape industry have much better margins for the wholesaler.

No editorializing or studies are needed here. It costs over $200 to vape 30ml of e-liquid from a Vuse Alto and $60 from a Lost Mary. Of course the companies trying to sell e-liquid at two hundred dollars per 30ml want rival products banned.

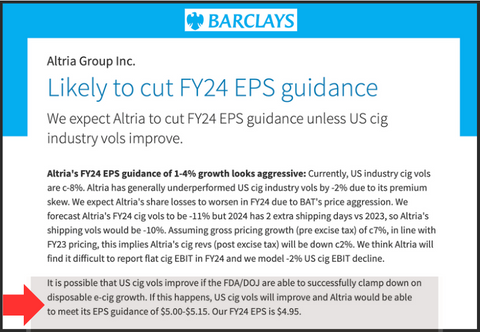

BIG TOBACCO BENEFITS FROM VAPE TAXES

The root of the Big Tobacco's push to shut down the competition can be found in a Barclay’s Earnings Report Guidance for Altria. Altria has decided eliminating the competition is the easiest solution.

To gain support for their efforts to put Americans out of work and drum up cigarette sales, Big Tobacco has turned to telling big lies about the vaping industry and American businesses that simply seek a level playing field.

But it is not all bad news for the tobacco industry, former FDA Chief Scott Gottlieb noted that declines in smoking have been effectively checked by the flavor bans and restrictions placed on vaping products. Even if MyBlu or Vuse are losing sales to disposable vapes, their legacy combustible products remain a cash cow that dominate shelf space and market share.

THE FUTURE OF CIGARETTE SALES

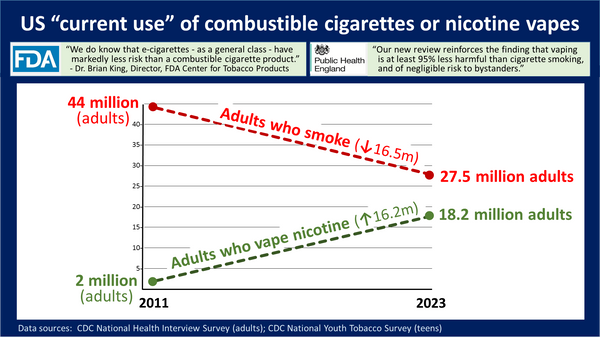

Smoking rates have been declining for almost 60 years. This progress has been checked by FDA regulations. An FTC report in the October 2021 found cigarette sales increased for the first time in a quarter century.

Even with this recent reversal of fortune, the erosion of the core cigarette business has been severe. As reported in the Wall Street Journal:

"According to data from Marlboro maker, cigarettes’ share of the U.S. nicotine industry fell to 60% last year, down from 80% in 2018. Smokers are switching to smoke-free products such as vapes in higher numbers than expected. If the trend continues, it will only take another three years for cigarettes’ share to slip below 50%."

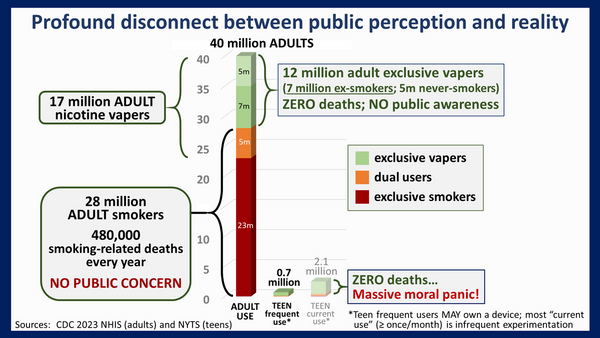

The table below shows where this pressure has been coming from. The US adult population has grown by some 23 million since 2011. The total number of adult nicotine users, be it tobacco, vapes or pouches, has declined.

The CDC reported in 2023 that e-cigarette use continues to decline among high school students. The easiest way for the tobacco industry to prevent a further depletion of their customer base is to eliminate the competition through regulatory capture or tax hikes that hit high-capacity vapes the hardest.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.